Received a Defective Return Notice? Filing your Income Tax Return (ITR) is a critical annual task for every taxpayer. However, it is not uncommon to make mistakes or miss essential details during the process. Such errors may lead to a "defective" return notice under Section 139(9) of the Income Tax Act.

Receiving such a notice can be alarming, but with proper understanding and action, it is manageable. This comprehensive guide will walk you through the concept of defective returns, reasons for receiving such notices, and how to respond effectively.

What is a Defective Return Notice?

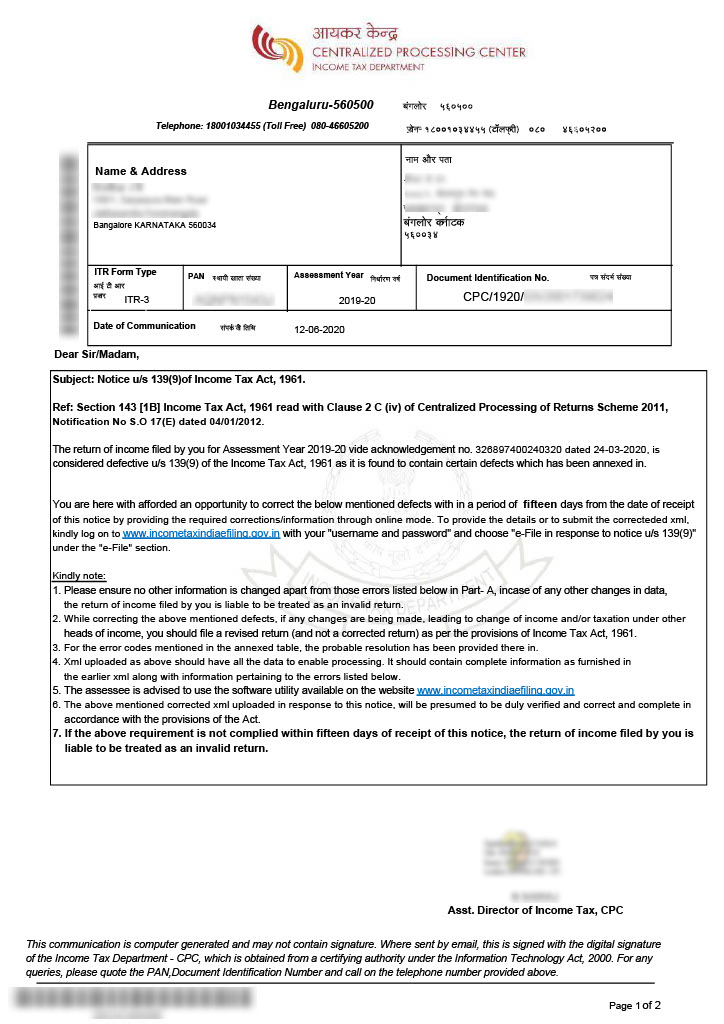

A defective return is one that contains errors, omissions, or discrepancies as identified by the Income Tax Department. When such issues are detected, the department issues a notice under Section 139(9), asking the taxpayer to rectify the errors within a stipulated time.

The notice typically highlights the nature of the defect and provides instructions for corrective action. This is an opportunity for the taxpayer to correct errors and avoid having the return treated as invalid, which could result in penalties, loss of refunds, and other consequences.

The notice is usually communicated via email or directly on the Income Tax e-filing portal, with a subject line such as:

"Communication under section 139(9) for PAN [Your PAN] for the Assessment Year [Year]."

Decoding the Defective Return Notice

The notice issued by the Income Tax Department is password-protected. To access it, use the following format:

PAN (in lowercase) + Date of Birth (DDMMYYYY)

For example:

- PAN: ABCDE1234F

- Date of Birth: 01/01/1990

- Password: abcde1234f01011990

Once unlocked, the notice will detail the defects in your ITR and provide instructions on how to resolve them.

Time Limit to Respond

Upon receiving the notice, you have 15 days to respond and rectify the defects. If you fail to respond within this timeframe, your return will be deemed invalid. In some cases, you can request an extension, but it must be approved by the Income Tax Department.

Failure to act promptly may result in:

- Loss of refunds

- Penalties and interest

- Loss of exemptions and benefits, such as carry-forward of losses

Common Reasons for Receiving a Defective Return Notice

1. Incomplete Details

- Missing annexures or schedules.

- Omission of income details from specific sources.

2. Mismatch in Tax Payment Details

- Taxes claimed as paid do not match the details in Form 26AS.

- Inaccurate TDS entries or omitted TDS.

3. Unreported Income

- Income related to claimed TDS is not reported in the return.

4. Incorrect ITR Form

- Filing an incorrect ITR form based on your income category.

5. Audit Compliance Issues

- Failing to attach audit reports when required, especially for business income.

6. Presumptive Taxation Errors

- Errors in declaring presumptive income under Section 44AD or Section 44ADA.

7. Bookkeeping Discrepancies

- Missing financial statements such as profit and loss accounts or balance sheets.

Understanding the specific reason for your defective notice is the first step toward resolving it.

Step-by-Step Guide to Respond to a Defective Return Notice

Step 1: Identify the Defect

Carefully read the notice to understand the defects mentioned. For instance, if there is a mismatch between your income details and Form 26AS, download your Form 26AS to cross-check.

Example:

- Defect Mentioned: "TDS claimed but related income not reported."

- Action Required: Verify the TDS details in Form 26AS and include the corresponding income in your revised return.

Step 2: Revise Your Return

To rectify the defect:

- Log in to the Income Tax e-filing portal.

- Download the original ITR file.

- Use tax-filing software or the e-filing utility to revise your return. Address the defects as highlighted in the notice. Ensure all income, deductions, and taxes are correctly reported.

- If additional tax is due, pay it through Challan 280 and update the payment details in the revised return.

Step 3: Generate the Rectified Return

- Generate the revised return in JSON format using the Income Tax utility or your tax-filing software.

- Save this file for upload.

Step 4: Submit the Response Online

- Log in to the Income Tax e-filing portal.

- Navigate to Pending Actions > E-Proceedings.

- Select the defective notice under Section 139(9).

- Choose the appropriate option:

- Agree: If you acknowledge the defect, upload the rectified JSON file.

- Disagree: If you believe the notice is incorrect, provide a detailed explanation.

- Complete the submission process.

Step 5: E-Verify the Submission

Once you submit the response, e-verify it using one of the following methods:

- Aadhaar OTP

- Net banking

- EVC (Electronic Verification Code)

- Digital Signature Certificate (DSC)

E-verification is mandatory to complete the process. Once done, you will receive an acknowledgment.

Consequences of Ignoring a Defective Return Notice

If you fail to respond or correct the defects within the stipulated time, the Income Tax Department will declare your return invalid. This can lead to several issues:

- Penalties and Interest: You may incur penalties under Sections 234F and 234A.

- Loss of Refunds: Refunds claimed in the defective return will not be processed.

- Ineligibility for Benefits: Loss of carry-forward benefits for losses and deductions.

- Increased Scrutiny: An invalid return could attract further scrutiny or notices.

Proactive Tips to Avoid Defective Returns

1. Use Reliable Tax Filing Software

Tax-filing platforms like ClearTax or TaxBuddy can help minimize errors by auto-populating details from Form 26AS and AIS.

2. Cross-Verify Tax Details

Before submitting your return, cross-check all income, deductions, and TDS entries with Form 26AS and Annual Information Statement (AIS).

3. Choose the Correct ITR Form

Selecting the wrong form is a common mistake. Consult a tax advisor if unsure.

4. Attach Required Documents

Ensure all mandatory annexures, statements, and audit reports are included when filing.

5. Seek Professional Help for Complex Returns

If your return involves audits, business income, or foreign assets, consult a Chartered Accountant or tax professional.

For More Information, Please Refer:

- ClearTax: How to File a Revised Return

- Income Tax Department: Understanding Defective Returns (ClearTax)

- TaxBuddy: Common Income Tax Errors

- CAclubindia: Section 139(9) Explained

Conclusion

Receiving a defective return notice under Section 139(9) can be stressful, but it is not the end of the road. By understanding the notice, identifying the defect, and taking prompt corrective action, you can resolve the issue effectively. Proactive measures, such as using reliable tax-filing tools and consulting professionals for complex filings, can help you avoid defective returns altogether.

Remember, compliance with tax laws ensures a hassle-free experience and builds trust with the Income Tax Department. Act promptly and meticulously to maintain your financial health and peace of mind.

FAQ's Related to Defective Return Notice

𝐂𝐚𝐧 𝐈 𝐫𝐞𝐯𝐢𝐬𝐞 𝐚 𝐫𝐞𝐭𝐮𝐫𝐧 𝐚𝐟𝐭𝐞𝐫 𝐢𝐭 𝐡𝐚𝐬 𝐛𝐞𝐞𝐧 𝐝𝐞𝐜𝐥𝐚𝐫𝐞𝐝 𝐢𝐧𝐯𝐚𝐥𝐢𝐝?

No, once a return is declared invalid, you must file a fresh return, and penalties may apply.

𝐖𝐡𝐚𝐭 𝐡𝐚𝐩𝐩𝐞𝐧𝐬 𝐢𝐟 𝐈 𝐝𝐢𝐬𝐚𝐠𝐫𝐞𝐞 𝐰𝐢𝐭𝐡 𝐭𝐡𝐞 𝐧𝐨𝐭𝐢𝐜𝐞?

You can submit a response explaining why you disagree with the defect. The department will review your explanation and may accept or reject it.

𝐇𝐨𝐰 𝐜𝐚𝐧 𝐈 𝐞𝐱𝐭𝐞𝐧𝐝 𝐭𝐡𝐞 𝐫𝐞𝐬𝐩𝐨𝐧𝐬𝐞 𝐝𝐞𝐚𝐝𝐥𝐢𝐧𝐞?

Log in to the e-filing portal and request an extension under the "Helpdesk" section. Approval is at the discretion of the department.